What just happened to the Spring market?

Well, the interest rate hikes over the past month or so definitely worked to slow down some of the crazy market activity, maybe too well. Many of the First Time Home Buyers (FTHB’s) had their dreams slashed when their lenders broke the news in the past few weeks that their estimated monthly payments would be way higher with the increase in mortgage rates. Many got priced completely out and others had to adjust expectations of what they could and could not afford now. Skyrocketing price appreciation and mortgage interest rates have many buyers sitting on the fence, even more so now. The Move Up Buyers are not being affected as much. A small adjustment here and there, and most buyers who are also sellers can still make their move into a new home using their equity gain to minimize their payments.

While today’s housing market is anything but normal, and admittedly inflated, it’s not because of the same circumstances surrounding the housing bubble of the early 2000s that caused that crash. Back then, new construction single-family homes flooded the market, lending standards were incredibly loose, and many homeowners were cashing out their equity left and right. Today’s market is nearly the exact opposite. The thousands of foreclosures that everyone was expecting won’t be happening as it did in the last correction. Today’s data shows that most homeowners are exiting their forbearance plans either fully caught up on payments or with a plan from the bank that restructured their loan in a way that allowed them to start making payments again. If they can’t work out a plan, most homeowners have enough equity to sell and make a few dollars still. While house price growth is expected to moderate from the rapid pace of 2021, strong home buyer demand and a historically tight inventory of homes for sale will likely keep appreciation positive in the coming year, with current estimates at 9% in 2022.

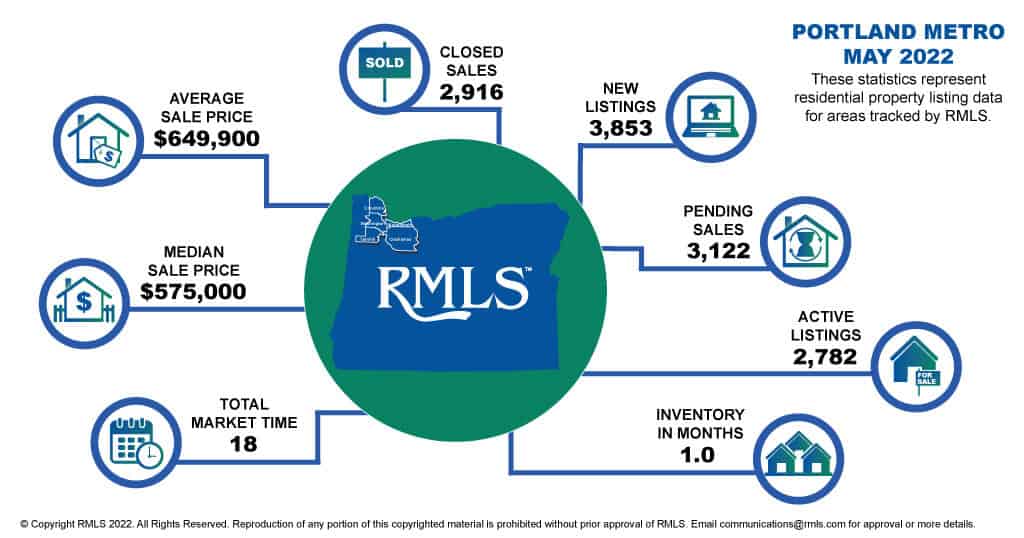

For April, year over year, Average Sale Price is up 11.3% ($543,900 vs. $605,600) and Median Sale Price is up 11.2% ($484,900 vs. $539,000). Inventory for sale rose slightly again to a still low of 0.08 months, 0.01 more than last month. New listings are down (9.4%) and Pending sales are down (11.6%) from last April, although Listings are up and Pending sales are down from last month. Sellers still remain in a great position to sell and will be able to realize a nice chunk of equity and appreciation when they do in most cases.