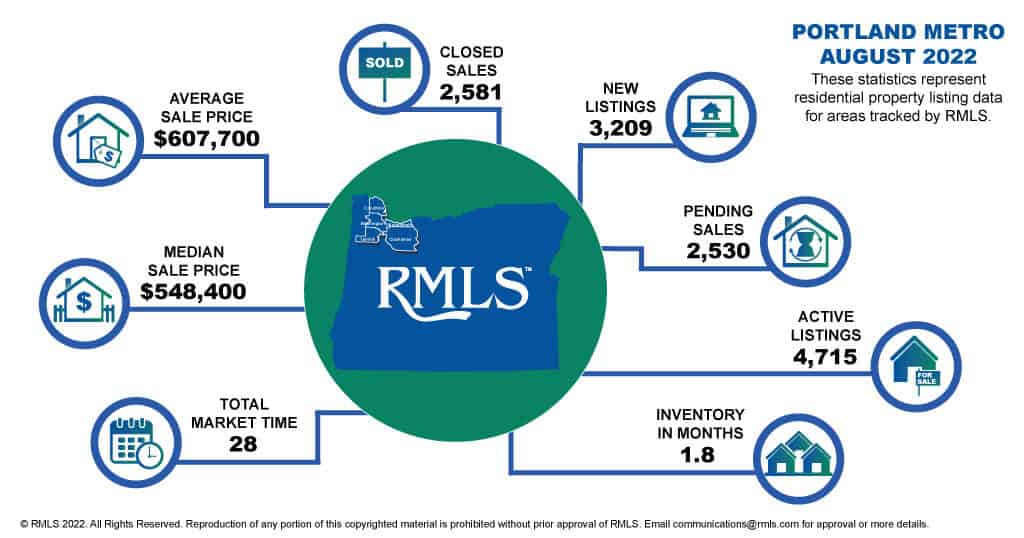

Observations about the current market…

1. Home Price Growth is Slowing Dramatically

Now read that again. It doesn’t say prices are dropping. It doesn’t say prices are crashing. It’s slowing. Dramatically.

Over the past 3-4 years, home prices have risen about 50%. We are due for some major slowing. We pretty much already got all the price growth we deserve for several years. Considering home prices historically rise 3-5% per year, we gained over 10 years in price growth in about 3. To me, this slowing is a welcome change. And yes, it happened fast, but it needed to. We were out of control and we needed a dramatic change. We are finally starting to balance out. And a balanced market is a good housing market for all. We are getting back on the right track.

2. Higher Interest Rates: Not Great For Inventory

This thought is borrowed from my lender friend Gavin…

If you’re waiting on a housing crash to get a good deal, just remember that sellers don’t have to sell. They can take their ball and go home.

If these rates make you uneasy, keep in mind that if/when rates drop, that likely won’t lead to better affordability; historically low rates just lead to increased prices. And if you buy now and rates drop you can refinance into a lower rate/payment (you can’t refi what you don’t own)

Most Sellers are sitting on an interest rate in the 3’s or lower. If they sell and buy another home they will double their interest rate to the 6’s. This is keeping most sellers in place. Only those who absolutely need to sell for some reason, have cash/enough equity to buy their next home, or are not planning on buying again, are selling. Therefore, the inventory is remaining low. Which inevitably keeps prices high.

3. The Home Builder’s Shift Toward Smaller U.S. Markets Continues

We are losing our builders in the big cities. With the price growth slowing, they can’t make the profits they used to. They need to go to more balanced markets that still have plenty of price growth to go. That isn’t helping the inventory situation either in the big cities. Notice the new home building is primarily on the borders of the metro area. The exception is apartments, Portland is still exploding with new apartment buildings.